As per Bain & Company, the total volume of M&A deals in 2022 amounted to 3.8 trillion, and the PWC M&A trends report predicts that there will be more deals by the end of 2023. This surge in mergers and acquisitions highlights the drive many businesses have toward expansion.

However, all successful businesses or startups are eventually faced with the challenge of whether or not to expand their business. In turn, business expansion brings numerous benefits to business owners, so it’s crucial to approach the preparations with diligence.

This article delves into mergers and the importance of using data room services when preparing for business expansion.

The rise of international mergers and the role of VDRs

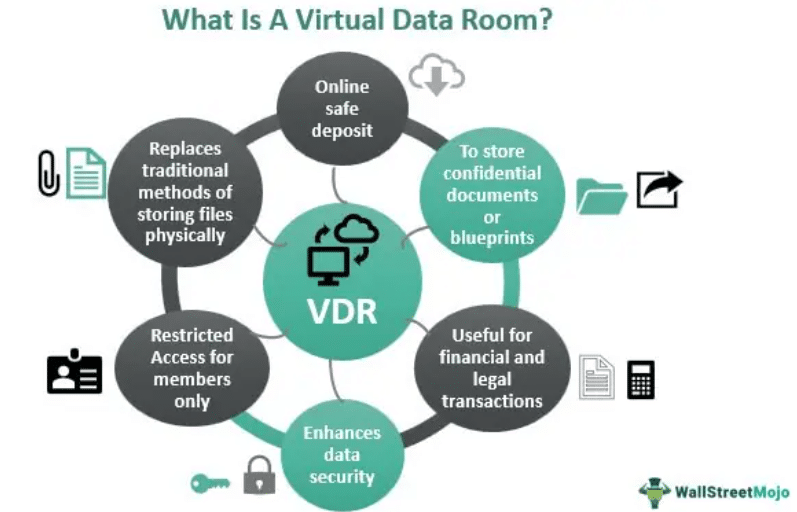

International mergers have become more common, which has led to an increase in the need for efficient and secure ways to manage transactional data. Many businesses now prefer to use virtual data rooms and centralized data storage platforms. In fact, digital solutions like VDRs help companies close transitions faster, which results in up to $45 million in additional value.

Below is an infographic showcasing the advantages and characteristics of VDR:

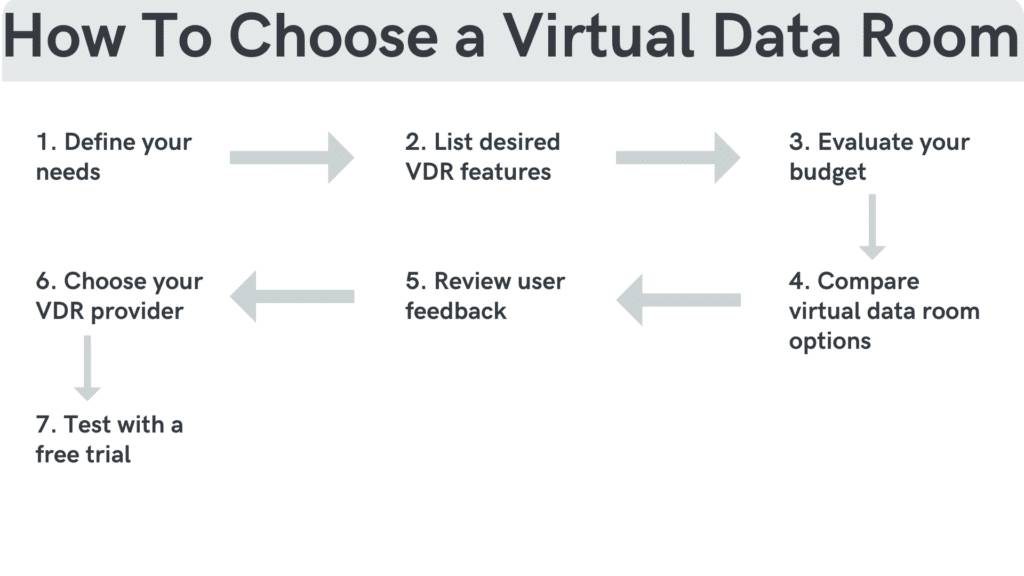

Before selecting a platform, conduct a thorough assessment of virtual data room providers. The right vendor provides a personalized electronic data room geared to your demands and industry, rather than a one-size-fits-all solution. Without the analysis, you risk investing in a platform that does not meet your needs, potentially leading to inefficiencies or security concerns.

Benefits of VDRs over traditional data rooms

When it comes to managing data during mergers and acquisitions, the transition from traditional data rooms to VDRs has revolutionized the process. Here are five notable advantages of virtual data rooms:

- Security. While traditional rooms were prone to breaches, theft, or accidental sharing, VDRs provide advanced encryption and digital security measures to protect confidential documents.

- Accessibility. Traditional data rooms required physical presence, which limited access and participation. In contrast, data room software enables authorized users to access documents from anywhere with an internet connection.

- Cost-effectiveness. Maintaining a physical space, including rental fees, security personnel, and document duplication, is significantly more expensive than the subscription or usage fees of online data room software.

- Efficiency. Traditional data rooms often caused delays with manual document handling and scheduling conflicts. On the other hand, VDRs expedite the M&A process by simplifying document uploads. It allows for easy searching of indexed documents and facilitates simultaneous access by multiple users.

- Real-time collaboration. VDRs allow multiple users to view, comment, and edit (with permission) documents in real time. It fosters better collaboration and quicker decision-making, unlike traditional rooms that limit collaborative efforts.

Selecting the perfect VDR for your M&A needs

KPMG’s M&A cloud data report indicates that over 40,000 companies are already reaping the benefits of data management solutions, such as virtual data rooms. With their growing popularity, one might ask, “How do you determine the best data room providers?”. A review of a data room plays a crucial role in making the right decision.

It’s crucial to diligently review and compare the prices and features offered by various providers. For a comprehensive data room review and a list of the best data room providers, please visit https://datarooms-review.com/.

Additionally, there is a step-by-step guide when choosing the virtual data room for your merger transaction.

Best practices for maximizing VDR efficiency during mergers

A study found that 87% of organizations effectively conducted their transactions using virtual technologies. This trend highlights the growing importance of virtual tools in critical business operations, such as mergers and acquisitions.

The proper deployment of a VDR considerably simplifies the merger process. Here are six best practices for making the most of your VDR:

- Systematically organize data. Use a clear and logical folder structure, ensuring that all papers are properly labeled and categorized.

- Set access permissions. Determine who has the ability to read, change, or download documents, maintaining the confidentiality and reducing potential data breaches.

- Use indexation. Ensure that papers are indexed so that they can be found quickly, saving users time.

- Backup regularly. Ensure there are regular backups of the content to prevent any data loss.

- Implement a Q&A section. To address inquiries, use built-in Q&A capabilities, which reduce the need for back-and-forth dialogue.

- Ensure 24-hour access. Ensure that the VDR is always accessible, catering to worldwide partners in different time zones.

Case study: VDR in a successful international merger

The case study below illustrates the crucial role of VDR in successful mergers.

- Context. Addleshaw Goddard, a prominent business law firm, facilitates M&A deals by advising clients on secure document-sharing methods.

- Role of VDR. The firm recognized that standard file-sharing platforms were not suitable for complex M&A processes, so they turned to data room vendors. This digital solution increased security by offering advanced features and providing 24/7 customer support. This created an efficient and reliable environment for managing documents during transactions.

- Results: Addleshaw Goddard used the virtual data room to successfully facilitate major transactions such as the £230m sale of PRUK by the Department of Health and substantial buyouts for Independent VetCare.

Key takeaways

- M&A transactions have been on an upward trend, highlighting the changing dynamics of corporate expansion and the resulting demand for virtual tools such as VDRs.

- VDRs outshine traditional data rooms by offering superior security, accessibility, and real-time collaboration at a reduced cost.

- It is critical to thoroughly evaluate VDR providers to select a personalized solution that ensures efficiency and security in mergers.