Venturing into business ownership is both an exciting endeavor and a considerable challenge. Whether it’s a promising startup or an established company looking to pass on its legacy, choosing the right business to take under your stewardship can be a daunting task.

Yet, with honed discernment, meticulous appraisal, and strategic acquisition, one can step into the shoes of a business owner with confidence and enthusiasm.

In this article, we’ll show you how to navigate the process of finding, evaluating, and acquiring the ideal business. With our comprehensive guide, you’ll be equipped to make a smart and informed decision.

Key Takeaways:

- Identifying potential business opportunities involves a thorough analysis of market demand and product availability.

- Evaluating the financial health of a business requires comparing owner income to business profit and understanding industry norms.

- Firm understanding of legal and regulatory compliance is necessary to assess a business’s solidity.

- Analyzing the key personnel and organizational structure provides insight into the business operations and responsibilities.

- A deep understanding of customer base and loyalty is instrumental in predicting future customer retention.

Identifying Potential Business Opportunities

To identify potential business opportunities, you should obtain catalogs of products and services offered by the business and gather information on pricing and delivery methods. This will give you a clear understanding of what the business offers and how it operates.

Assessing the market demand for products and services is a crucial part of identifying a promising business opportunity. For instance, if considering an Ottawa business for sale, you would need to evaluate the competitiveness of their offerings in the local and wider markets.

Additionally, it is essential to ascertain if there are any restrictions or limitations placed on selling the products or services. This could potentially inhibit market penetration or limit expected profits, and should be meticulously examined during the evaluation phase.

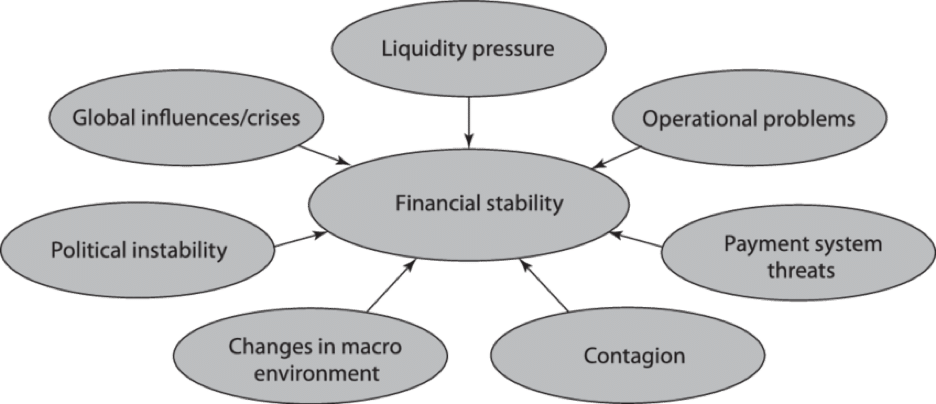

Evaluating Financial Health and Stability

Assess if the business’s profitability aligns with industry norms by comparing owner income to business profits. This will give you an idea of how well the business is performing financially.

If the owner is making a substantial amount of money from the business, it suggests that the business is profitable. However, if the owner’s income is significantly lower than the business’s profits, it may indicate that the business is not as profitable as it seems.

It’s important to consider industry standards and benchmarks when evaluating the financial health and stability of a business. By doing so, you can make an informed decision about whether or not to acquire the business.

Assessing Legal and Regulatory Compliance

Examine the incorporation documents and other formation documents to ensure legal and regulatory compliance. These documents provide important information about the business’s legal structure and its compliance with applicable laws and regulations.

Review the articles of incorporation, bylaws, and any other documents that establish the business’s legal entity. Pay attention to any required filings or permits that may be necessary for the business to operate legally.

Additionally, check for any ongoing or past litigation involving the company or its owners. This will help you assess any potential legal risks or liabilities that may impact the business’s operations or future growth.

Analyzing Key Personnel and Organizational Structure

Take a closer look at the key personnel and organizational structure to gain a better understanding of how the business operates and who is responsible for each role. This will help you make informed decisions when evaluating and acquiring a business.

Here are four important factors to consider:

1) Identify the key personnel

Look at the senior-level employees and their job descriptions. This will give you an idea of the expertise and experience they bring to the business.

2) Assess the organizational structure

Review the organizational charts to see how different departments and teams are structured. This will help you understand how information flows within the business and how decisions are made.

3) Evaluate the professional advisors

Gather information on the accountants, lawyers, and insurance agents associated with the business. Their expertise and reputation can greatly impact the success of the business.

4) Consider the classification of independent contractors

Determine if the business relies on independent contractors and assess their roles and responsibilities. This will help you understand the level of reliance on external resources.

Understanding the Customer Base

In your approach to business acquisition, understanding the customer base is an essential component. You should prioritize reviewing accounts receivable to ensure the financial reliability of existing customers.

This review should include a comprehensive rundown on the company’s major customers. Understand what percentage of revenue they account for, their significance to the company’s profitability, and their purchasing history.

Moreover, it is pivotal to introspect on customer relationships. Do the customers demonstrate loyalty to the existing owner or do they pledge their allegiance to the company or brand?

This aspect can significantly impact future customer retention. Unraveling these details will provide an insightful perspective on the company’s potential for both stability and growth under new ownership.

Conclusion

The decision to acquire a business is a significant one that involves comprehensive research and careful evaluation. Factors such as market demand, financial health, regulatory compliance, organizational structure, and customer base are critical areas to explore.

As a potential business owner, your ability to conduct a meticulous appraisal and strategize your acquisition can dramatically influence your chances of success in the exciting world of entrepreneurship. Armed with these insights, you are on your way to making a smart, informed business acquisition.

FAQs

Q: How do I determine if the business’s asking price is fair?

It’s advisable to hire a business appraiser who will consider market conditions, the business’s financial health, and comparable sales. It’s also worth comparing the asking price with the earnings multiplier for the industry.

Q: How important is location when acquiring a business?

Location can significantly impact a business’s success. It affects accessibility, visibility, and can directly influence revenue. It’s also wise to consider factors like potential for growth and local competitors.

Q: What should I consider when taking over existing employees?

Consider their skills, experience, and contribution to the business. Check if the key staff are likely to stay after the sale and whether there are effective training programs in place for a smooth transition.

Q: Do I need a lawyer when acquiring a business?

While not mandatory, having a lawyer is advisable. They can review contracts, ensure compliance with acquisition laws, and provide advice throughout the process.

Q: What are some red flags to look for when buying a business?

Red flags can include inconsistent financial records, unchecked legal disputes, a sudden increase in seller urgency, high employee turnover, or significant customer dependence. It’s crucial to address these before finalizing any deal.