The Forex market, or foreign exchange market, is a critical component of the global financial landscape, particularly in Australia. Understanding its dynamics is vital for any investor or business looking to navigate the complexities of international trade and currency fluctuations.

This detailed guide aims to provide a comprehensive overview of the current state of the Forex market in Australia, drawing on the latest Semi-Annual Report on Foreign Exchange Turnover from April 2022.

Overview of the Australian Forex Market Heading in 2024

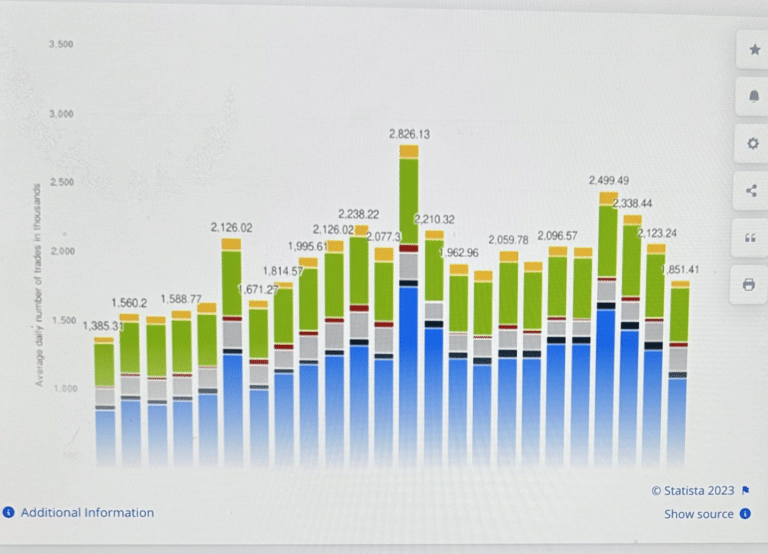

The Australian Forex market has shown significant growth and dynamism in recent years. In April 2022, the average daily turnover in all over-the-counter (OTC) foreign exchange instruments in Australia reached US$150.4 billion. This figure represents a substantial increase from previous years and indicates the growing importance of Forex trading in Australia’s financial landscape.

Key Findings from the Semi-Annual Report:

- The total average daily turnover in all OTC foreign exchange instruments in April 2022 was US$150.4 billion.

- Traditional OTC foreign exchange instruments, including spot, outright forwards, and foreign exchange swaps, accounted for US$145.6 billion daily turnover.

- The remaining turnover consisted of OTC options and cross-currency interest rate swaps, amounting to US$4.8 billion.

Trends and Changes in the Market

The Australian Forex market has seen several notable trends and changes:

- Increase in Turnover: There was a 26% increase in turnover from April 2019 to April 2022. This outpaced the global increase of 14%, highlighting the growing prominence of the Australian market.

- Continued Relevance of FX Swaps: FX swaps remained the most significant portion of FX turnover in Australia, representing 57% of total turnover.

- Dominance of FX Swaps and Outright Forwards: The growth was mainly driven by increased turnover in FX swaps and outright forwards, likely reflecting a heightened demand for hedging products amid global financial uncertainties.

- Growth in Outright Forwards: The outright forwards market saw a 66% increase, far exceeding the global growth rate in this segment.

- Steady Spot Market Activity: The Australian spot market remained relatively stable, contrasting with a global increase. Spot trades accounted for 23% of the total turnover in Australia.

Currency Dynamics

The Australian dollar (AUD) continues to be a significant player in the Forex market. The AUD/USD pair alone accounted for 41% of the total FX turnover in Australia. There was also noticeable growth in the turnover of other major currency pairs like EUR/USD and USD/JPY, while NZD/USD saw a decline.

Interaction with Global Trends

The Australian Forex market’s trends reflect broader global movements with unique local characteristics. The increase in the turnover of derivatives, the stable spot market, and the evolving currency pair dynamics all mirror global patterns. Yet, they are shaped by Australia’s specific economic and financial environment.

OTC Interest Rate Derivatives

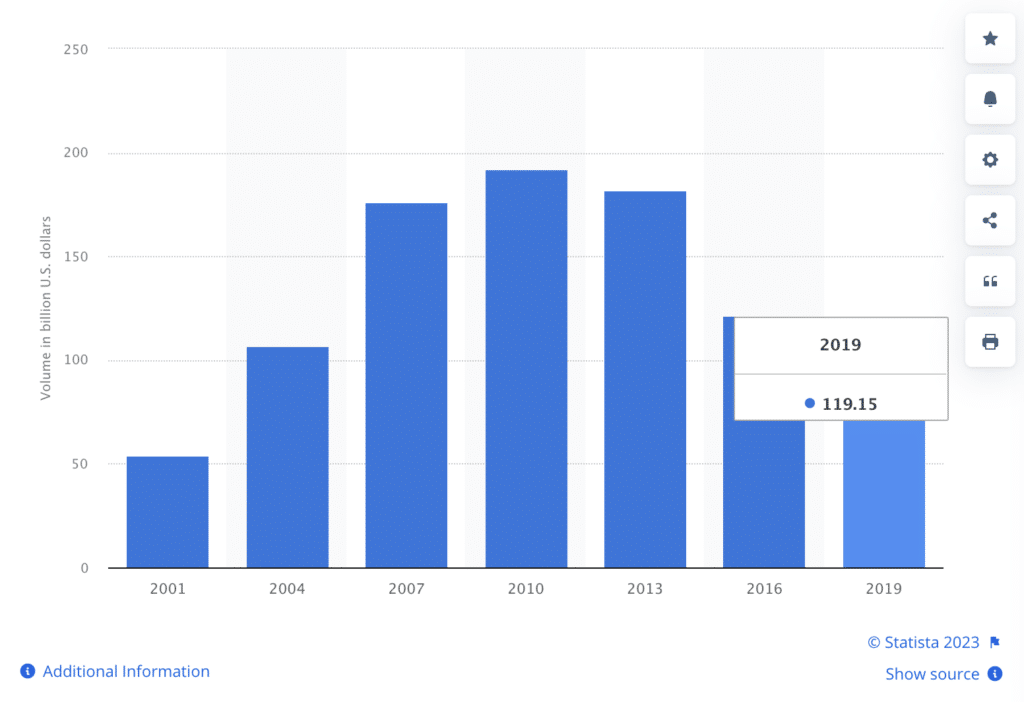

In addition to Forex, Australia’s OTC interest rate derivatives market also saw notable activity. In April 2022, the turnover in this segment averaged US$113 billion per day, a 16% increase from 2019. Most of this turnover was in interest rate swaps, with a significant portion being overnight indexed swaps (OIS).

Key Observations:

- Growth in Interest Rate Swaps: The interest rate swaps market experienced a 34% growth.

- Decrease in Forward Rate Agreements: There was a significant decrease in forward rate agreements, aligning with global trends.

- Diverse Counterparty Interactions: The interactions between reporting dealers and local financial institutions saw a considerable increase, while transactions with overseas financial institutions grew, albeit slower.

The local Forex market is a dynamic and integral part of the global financial system, marked by significant growth and evolving trends. Understanding these trends is crucial for businesses and investors across the country. The data presented in this analysis, derived from the Reserve Bank of Australia’s semi-annual report, provides valuable insights into the current state and future trajectory of the Forex market in Australia.

| Category | Detail | Description |

| Currency Pair Dynamics | AUD/USD as the Most Traded Pair | The AUD/USD pair remains the most actively traded currency pair in Australia, signifying the strong ties between the Australian and American economies. |

| Rise of Other Major Pairs | The EUR/USD and USD/JPY pairs have increased trading activity, reflecting broader global economic shifts. | |

| Emergence of USD/CNY | The USD/CNY pair has gained prominence in the Australian market, aligning with China’s growing influence in the global economy. | |

| Transactions with Financial Institutions | Increased Local Interactions | Transactions between reporting dealers and local financial institutions saw an 86% increase, emphasizing the growing role of domestic financial institutions in the Forex market. |

| Steady Overseas Transactions | Transactions with overseas financial institutions also grew but at a more moderate pace. | |

| Non-Financial Institutions | Rise in Non-Financial Transactions | There was a significant increase in transactions with non-financial institutions, though they still account for a relatively small portion of the overall turnover. |

| Impact on the Australian Economy | Significant implications for economic health and global interconnectedness | The Forex market’s growth and evolving dynamics have considerable implications for the Australian economy. The increasing volume of trade and the diversification of currency pairs reflect Australia’s expanding role in global finance and its interconnectedness with major economies around the world. |

Conclusion

The Forex market in Australia presents a dynamic and evolving landscape characterized by significant growth, changing market segments, and shifting currency dynamics. Understanding these trends is crucial for businesses, investors, and policymakers alike.

The data and analysis provided here offer a comprehensive view of the current state and potential future directions of the Forex market in Australia, highlighting its importance in both the domestic and global financial contexts.

This overview serves as an essential resource for anyone seeking to navigate the complexities of Forex trading in Australia, offering a clear and factual understanding of the market’s current state and future potential.