To run your business efficiently, you need to know your market dynamics. Industry analysis is crucial for sound business management. Without knowing the market forces at play, you will have a hard time staying ahead of your competition. The goal is to learn as much as you can about your industry without succumbing to paralysis by analysis (see The Biggest Mistake Founders Make When Starting Their Business for more on paralysis by analysis). So, what is the best way to learn about your industry? Simple, through using porter’s five forces analysis.

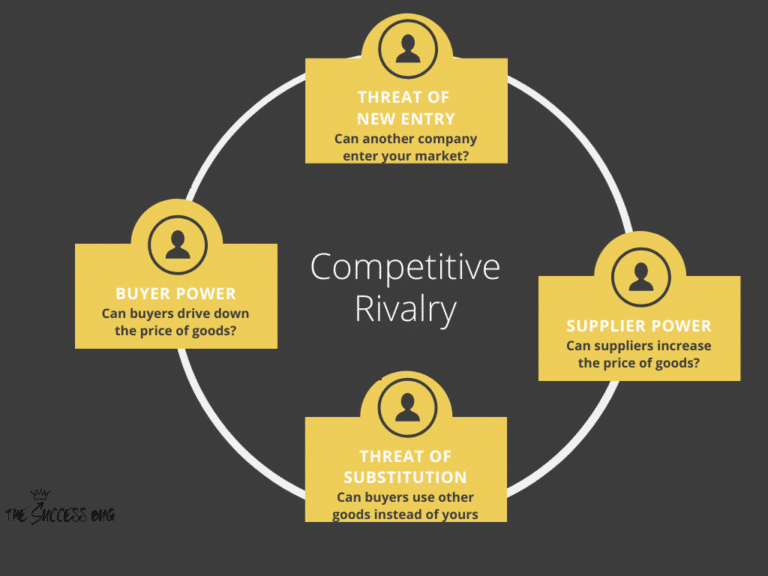

Porter’s Five Forces is a powerful tool, created by Harvard Business School professor Michael Porter, that was designed to understand the competitiveness of a business environment and enables individuals to identify potentially profitable opportunities. Michael Porter identified five forces that make up the competitive environment of a business landscape. The lower these five forces, the more lucrative a business idea is. These forces are:

- Threat of New Entrants

- Rivalry Among Existing Competitors

- Threat of Substitute Products

- Supplier Power

- Buyer Power

Porter’s Five Forces: Why Should I Use It?

When Michael Porter created Porter’s Five Forces, he intended businesses to use it to determine an industry’s profit potential and attractiveness. Dating back to its publication in 1979, it has grown to become one of the most used business strategy tools in the world.

If you use Porter’s Five Forces, you’ll understand if a business idea is worth pursuing. Not only that but if you already own a business, you’ll be able to understand your potential competition better. In this post, you’ll learn about the five different aspects of Porter’s Five Forces and how you can use them to create or strategize for your business.

1. Threat of New Entrants

The threat of new entrants refers to the likelihood of another company being able to enter your market space. Would it be easy for another company to do what you’re doing? What are your barriers to entry? Is your sector regulated or have high start-up costs? Does it take specific certifications?

An example of a high threat of new entrants business would be a dog walking business. Dog walking doesn’t take a college degree or a large sum of money. Anyone around the neighborhood could potentially start taking your clients. Boeing, the airplane manufacturer, has a shallow threat of new entrants. To manufacture and sell airplanes, you need millions of dollars, multiple certifications, approvals from the FAA, and lots of time.

Barriers To New Entry

The actual threat of new entrants depends on the barriers to entry. These barriers include different roadblocks that can discourage potential competitors from entering your market space. Here are some of the most common barriers to new entry:

- Brand Loyalty: Customers in the industry show a strong preference for the products or services of companies that already exist

- Cost advantages: Companies that already exist can offer the same product or service at a markedly lower price than you can

- Access to suppliers and distribution channels: Existing firms own exclusive rights to suppliers + distribution channels

Porter’s Five Forces Tip #1: Always consider the likelihood of a competitor entering your market space

2. Rivalry Among Existing Competitors

The rivalry of existing competitors refers to how competitive the existing industry is and how many competitors you have. Who are your competitors, and how does the quality of their product stack up to yours? Are they constantly trying to undercut your prices and offer a better deal? Is there significant brand loyalty with high switching costs? Are you all competing for the same customers, or is the market large enough where you can target different segments?

Two examples of high rivalry among existing competitors are ride-hailing services and food delivery services. Lyft and Uber are always offering discount codes for their riders so that they can gain more customers. Food delivery services like Grubhub, Seamless, and DoorDash offer close to free meals to initial customers to get them to use them instead of their competitors. Companies that fall into this segment are often never profitable.

Organizations like non-for-profits, utility companies that work in certain areas, and government-subsidized organizations are examples of industries that have very low rivalry among existing competitors. These are much harder to come across and usually can only function if governments fund them.

Porter’s Five Forces Tip #2: Understand who your competitors are and how their business model compares to yours

3. Threat of Substitute Products

The threat of substitute products refers to the products that customers can use instead of your product to accomplish the same goal. Is the solution you offer unique to your product, or are there other products that can do the same thing? Is the switching cost from one option to another high for your customers? Is the additional option of equivalent quality? Specifically, the following factors cause a higher threat of substitutes for an industry:

- Customers can easily switch between products.

- Substitute products are readily available to customers.

- Substitute products have better features than similar products within the space.

- Substitute products are more reliable than similar products within the space.

- Substitute products cost less than similar products within the industry.

An example of a high threat of substitute products is breakfast food. Quaker Oats doesn’t just have to worry about the threat of other oatmeal companies, but of all companies that offer breakfast food. Instead of eating oatmeal for breakfast, someone can have eggs and bacon, cereal, a breakfast bar, or maybe some fruit and yogurt.

An iPhone would be an example of a product that has a low threat of substitutes. The only other object that can call, text, use apps, and host information like an iPhone would be a computer, and even then, that isn’t a mobile device.

Don’t be confused, the iPhone surely has competitors in other smartphone providers, but there are close to no other options that can accomplish the same thing the iPhone can, that isn’t a smartphone itself.

Porter’s Five Forces Tip #3: Understand the threat of products that customers might be able to use instead of yours

4. Supplier Power

The supplier power section of Porter’s Five Forces refers to the ability of a supplier to increase their prices. How many potential suppliers are available, and how expensive would it be to switch from one supplier to another? How much does your supplier rely on your business for their revenue?

An example of a high supplier power industry is cocoa supplying countries. The Ivory Coast and Ghana own 60% of the world’s cocoa, meaning they can raise cocoa prices, and companies like Hersey, Mondelez, and Nestle will have very few alternatives. Skilled trade workers like plumbers, electricians, and coders have low supplier power. Many companies offer services similar to skilled trade workers, where no one would have to rely on just one company.

Porter’s Five Forces Tip #4: Understand the ability of suppliers in your industry to increase their prices

5. Buyer Power

Buyer power refers to the ability of a buyer to drive down the prices of goods. How many buyers are there, and how big are their orders? How much would it cost them to switch to another supplier? What percent of their costs come from the product they purchase?

An example of high buying power can be seen when purchasing large items like a vacation, a house, a car, or anything else in that range. There are many options for buyers when buying large ticket items, and buyers can make their decision based on anything from quality to cost.

Low buying power can be seen when choosing which soft drink company you wish to purchase from. Either Coke or Pepsi owns the majority of soft drink companies. As you can see, the supplier power and buyer power are inverses of one another. If a company has high buyer power, its supplier probably has low supplier power.

Porter’s Five Forces Tip #5: Understand how many potential buyers of your product there are, and how big their orders might be

Key Takeaways:

Porter’s Five Forces are as follows:

- The Threat of New Entrants: The likelihood of another company being able to enter your market space

- The Rivalry of Existing Competitors: Refers to how competitive the existing industry is and how many competitors you have

- The Threat of Substitute Products: Refers to the products that customers can use instead of your product to accomplish the same goal

- Supplier Power: The ability of suppliers to increase their prices

- Buyer Power: The ability of a buyer to drive down the price of goods

By using Michael Porter’s Five Forces, you can analyze any industry and measure it’s intensity, attractiveness, and profitability. Do you have a high threat to entry? If so, see if you can add features to your product that will lead to a high switching cost, deterring your customers from leaving for a new product. Do you have a high threat of substitutes? See if you can offer other products within your space so that your customers can shop directly with you if they feel the need to substitute your other products.

By seeing what your strengths and weaknesses are in your industry and planning accordingly, you can better position your company to take advantage of potential opportunities. The simplest way to do this is by using Porter’s Five Forces and then looking at what strategic changes you need to make to earn profit long-term.

Enjoyed this article? Then you’ll love our post on How To Go From Startup Idea To Business Model. We take a deep dive into the Business Model Canvas, another highly regarded business strategy tool!