It can be difficult to get a car loan if you have bad credit. Car dealerships and lenders are usually unwilling to offer their best rates and terms to customers with poor credit scores.

Because of this, it’s important to come prepared for a higher interest rate and other unfavorable terms. However, there are still several ways to get a car with bad credit. In this article, we’ll break down what you can do to improve your chances of getting a car loan with bad credit.

We’ll also discuss some of the factors that car dealers and lenders take into account when reviewing an application.

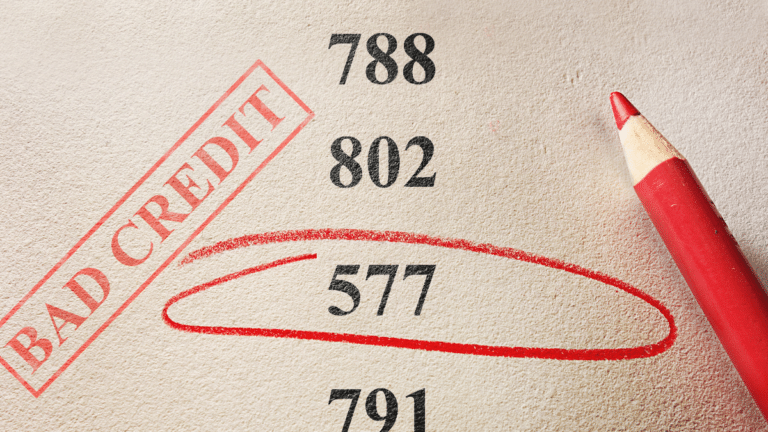

What Is Bad Credit and How Does It Affect Car-Buying Decisions?

Bad credit is generally a FICO score of 620 or below. This puts you in the “subprime” category, which can make it harder to get approved for a loan or lease. This also usually results in higher interest rates and monthly payments.

Car dealerships may be hesitant to work with you if you have bad credit, so it’s important to do your research ahead of time and be prepared for potential rejection.

However, there are still several ways you can get car financing even with a low FICO score.

Improving Your Credit Score

Before anything else, your first solution should be to improve your credit score. If your score is currently below 620, there are a few things you can do to improve it:

- Check your credit report for errors and dispute any inaccuracies. This is one of the most important steps you can take to improve your credit rating. You are eligible for one free copy of your credit report from each of the three major credit bureaus (Experian, TransUnion, and Equifax) every year at AnnualCreditReport.com.

- Make all of your payments on time. Payment history is the most important factor in your FICO score, so it’s important to make sure you’re never late with a payment. Set up automatic payments if necessary to make sure you always pay on time.

- Use a credit-builder loan. A credit-builder loan is a type of loan specifically designed for people with poor credit. The lender puts the loan proceeds into an interest-bearing savings account, and you make monthly payments directly to the lender. At the end of the loan term, you receive the funds in full and the interest is credited to your account.

Other Ways to Improve Your Credit Score

- Set up a car-buying budget. A car is a big purchase, and it’s important to make sure you can afford it. Set up a car budget that includes all of your car-related expenses. This can include insurance, fuel, car payments, and maintenance—that you can comfortably afford. This will not only help you improve your credit, but give you an idea of what is within your budget.

- Pay down your debts, especially revolving debts like credit cards: Revolving debt, like credit cards, can hurt your credit score. Try to pay down these debts as much as possible to improve your score.

- Keep old accounts open, even if you don’t use them often. Closing old accounts can hurt your credit score, so it’s best to keep them open unless they charge an annual fee.

- Apply for new credit only when necessary. It can be tempting to apply for a bunch of new credit cards when you’re trying to improve your score, but it’s important to be strategic about it. Only apply for new credit when you need it and be sure to shop around for the best rates and terms.

These steps won’t improve your score overnight, but they will put you on track to getting the car you want.

Factors That Car Dealers and Lenders Look at When Considering a Car Loan Application

When reviewing your car loan application, car dealerships and lenders typically consider several factors, including:

- Your credit score. This is the most important factor, as lenders and car dealers generally won’t offer favorable terms to customers with poor credit scores.

- Any late payments or other negative marks on your credit report. Late payments, bankruptcies, foreclosures, etc. can all negatively impact your car loan application.

- Your income level and employment status. Lenders want to be sure that you can afford your car payments, so they may ask for documentation of your income level and employment status.

- The type of car you are buying or leasing and its resale value after a few years. Lenders may be more willing to finance a car with a higher resale value, as this means they are less likely to lose money if you default on your loan.

Other factors such as the amount of your down payment, car insurance coverage, and trade-in car may also be taken into account when car dealerships and lenders are deciding on your loan application.

Things You Can Do to Improve Your Chances of Getting a Car Loan With Bad Credit

For people with bad credit, car loan options typically include higher interest rates and less favorable terms. However, there are still several ways to get a car with bad credit. Some of the best car loan options for people with bad credit include:

- Applying for a car loan through an online lender or peer-to-peer lending network: these options may be more flexible in terms of offering lower interest rates to customers with low credit scores.

- Applying for a car loan through your local credit union: credit unions often have lower car loan rates than traditional car dealerships or banks, making them a good option for people with bad credit.

- Shopping for car loans with credit unions or car dealerships that specialize in bad credit car loans: these lenders are more likely to work with you if you have a poor credit score.

- Making a large down payment: this will lower the amount you need to finance, and may make car dealerships and lenders more willing to work with you.

- Considering car lease options instead of car loans: car leases often have lower credit score requirements than car loans, making them a good option for people with bad credit.

No matter what type of car loan you choose, it is important to do your research. Make sure you compare offers from multiple lenders before making a decision.

This will help you find the best car loan option for your individual needs and financial situation.

Key Takeaway

Bad credit can have a significant impact on car-buying decisions. Car dealerships and lenders are usually unwilling to offer their best rates and terms to customers with poor credit scores.

However, there are still several ways to get a car with bad credit. What factors does a car dealership or lender consider when reviewing an application? There are a few main factors car dealerships and lenders examine when assessing car loan applications.

These include your credit score, payment history, credit utilization ratio, and the type of car you are buying.

To improve your chances of car loan approval with bad credit, you should check your credit report for errors. Additionally, you may want to consider car loan options with lower interest rates.

These can include credit unions or car dealerships that specialize in bad credit car loans. Overall, the best car loan options for people with bad credit include applying for a car loan through an online lender or peer-to-peer lending network, shopping around for car loans from multiple lenders, and increasing your income level.

Comparing car loans can be tricky, but we’ve got you covered. You can also use The Success Bug’s car loan calculator. Our free tool will help you estimate monthly payments, compare interest rates, and choose the best car loan for you. Good luck!